From high-standard markets to global value of Vietnamese brands

In the flow of global economic integration, emerging markets like India offer momentum and expansion opportunities, while high-standard markets such as the European Union (EU), the US, and Japan serve as crucibles for testing competitiveness and establishing a national brand identity.

Core commodities affirm Viet Nam’s position

Viet Nam is increasingly asserting its economic status on the global stage through the strong performance of its core commodities — not only as a “manufacturing hub” but also as a trusted trading partner. In demanding markets like the UK, the Republic of Korea (RoK), and India, "Made in Viet Nam" products and services are gradually making a mark and elevating the country's brand profile.

Agricultural products and processed foods are leading the way. Tuyen Quang Province has successfully exported its first One Commune, One Product (OCOP) shipment to the UK, featuring guava tea, male papaya flowers soaked in honey, soft-dried bananas, black bean (green-centred) tea bags, lemon syrup, and kumquat syrup. Notably, Soi Ha pomelos passed 923 food safety and residue tests and received immediate orders upon their debut — demonstrating Viet Nam's ability to meet stringent international standards like VietGAP, GLOBALG.A.P, organic certifications, and ISO.

Assessing the bilateral trade between Viet Nam and the UK, Agriculture, Food and Drink Attaché at the British Embassy in Viet Nam Matthew Albon-Crouch said: "The trade between the UK and Viet Nam has shown consistent growth since the implementation of the UK - Viet Nam Free Trade Agreement in 2020. In fact, exports from the UK to Viet Nam increased by 97% between 2019 and 2023, largely thanks to increased exports of Scotch Whisky and seafood products. Exports from Viet Nam to the UK have also grown exponentially, largely due to shirmp, coffee and cashew exports."

In the RoK, Vietnamese agricultural goods and cuisine are gaining popularity, thanks to growing consumer confidence in the quality of Vietnamese-branded products. Meanwhile, in India, products such as Trung Nguyen G7 instant coffee, black pepper, cinnamon, cashew nuts, tea, tra (pangasius) fish fillets, and dragon fruit are making a strong impression. Viet Nam is now the largest cinnamon supplier to India, commanding 85% of its import market. These products are praised for their consistent quality, food safety, and competitive prices. However, to elevate them to national brand status, additional investment is needed regarding geographical indications, traceability, packaging, and professional branding.

Electronics and components are among Viet Nam’s top export sectors. In India, this product group has consistently led in export value, reaching approximately 2.5 billion USD in 2024. In the first five months of 2025 alone, exports of phones and components reached 960 million USD, highlighting Viet Nam’s growing role in the global electronics supply chain. This success reflects Viet Nam’s strategic use of India’s “Make in India” policy and the ASEAN–India Free Trade Agreement (AIFTA). Additionally, many Korean companies have identified Viet Nam as a “global strategic manufacturing hub”, citing advantages in cost, labour, and location.

The wood and wood products sector is also expanding steadily in emerging markets. In India, Viet Nam is the third-largest wood and wood products exporter, following China and Malaysia, with a year-on-year surge in export value of 293% in 2023. Products like MDF, plywood, and veneer suit the needs of India’s urban furniture markets. In the RoK, consumers increasingly trust Vietnamese wood products due to environmentally friendly designs and traceable production processes.

Aviation and tourism services have become powerful brand ambassadors for Viet Nam. In the RoK, Viet Nam is a top travel destination, attracting 4.6 million Korean tourists in 2024. In India, Vietnam Airlines and Vietjet Air are highly rated by tour operators and passengers for their reliable service and quality. Vietjet in particular has gained strong brand recognition and consumer satisfaction in the RoK market. Travel companies like Vietravel have also pioneered tours bringing Indian tourists to Viet Nam, opening new opportunities for tourism and cultural exchange.

Other emerging sectors are gradually establishing their foothold in global integration. The textile and garment industry is receiving positive responses in the RoK, especially for eco-friendly products such as recycled fibre and wastewater treatment technology. Vietnamese traditional handicrafts are attracting renewed interest in both the RoK and India, creating opportunities for culturally rich products such as bamboo, rattan, and ceramics.

In the automotive industry, VinFast has entered the Indian market, gaining attention for its electric vehicles, which align with global green consumption trends.

From key to emerging sectors, one common thread stands out: Vietnamese goods and services are no longer entering the global market as ordinary products, but increasingly carry the stories of quality, cultural identity, and national stature. To sustain and enhance this position, it is essential to make long-term strategic investments in product quality, packaging, standards, and localisation. Most importantly, efforts must focus on building strong, methodical branding, and professional communication, while effectively leveraging next-generation free trade agreements and the growing trend of sustainable consumption.

Overcoming barriers to assert national value

Beyond manufacturing capacity, the rise of several Vietnamese tech enterprises demonstrates a clear shift in domestic innovation capabilities.

Matthew Albon-Crouch, Agriculture, Food and Drink Attaché at the British Embassy in Viet Nam gives interview to Nhan Dan Newspaper.

Matthew Albon-Crouch, Agriculture, Food and Drink Attaché at the British Embassy in Viet Nam gives interview to Nhan Dan Newspaper.

A standout example is Aubot – Automation & Robotics, a member of CF Group, which specialises in developing Automated Guided Vehicles (AGVs) for seaports, factories, and airports. The idea was sparked unexpectedly when a Japanese partner inquired whether the company could produce AGVs. In response, entrepreneur Phan Quang Cuong and his team of Vietnamese engineers developed a working prototype within just one month. After five years, Aubot has exported more than 600 AGV units to Japan, the Philippines, and Indonesia, and has become a trusted supplier for multiple foreign-invested enterprises (FDIs) in Viet Nam.

Aubot’s story is not merely one of individual effort but also stands as a symbol of a new generation of Vietnamese tech entrepreneurs, steadily and methodically rising with a vision for proactive global integration.

At the same time, the overseas Vietnamese are emerging as “soft power brand ambassadors”. Tran Hai Linh, Chairman of the Viet Nam-Korea Businessmen & Investment Association (VKBIA), emphasised: “Every exported product reflects the image of the nation. With strong product quality and well-crafted communication, overseas Vietnamese can serve as vital bridges between markets and local consumers.”

From global trade fairs and Viet Nam Weeks in Tokyo, Berlin, and Paris to the idea of establishing a “Viet Nam Brand Gateway” on platforms such as Amazon, Flipkart, and Naver, the Vietnamese diaspora and businesses are playing a pivotal role in systematically bringing Vietnamese brands to the world stage.

Three strategic pillars to elevate the Vietnamese brands

To realise the ambition of asserting Viet Nam’s position on the global trade map, the country must pursue strategic, proactive, and synchronised policies — not merely to overcome barriers, but to establish a national brand identity within the global value chain. Drawing from practical experiences in high-standard markets, success stories of Vietnamese enterprises, and the growing role of the overseas Vietnamese community, three key policy directions have emerged.

According to economic experts and trade counsellors, the first priority is to accelerate the mutual recognition of Viet Nam’s technical standards in major markets — especially the EU, the US, Japan, and the RoK. Promoting the recognition of Vietnamese standards, technical regulations, and quality certifications would significantly reduce time, cost, and compliance risks for exporters. More importantly, such recognition serves as a testament to the credibility of Viet Nam’s quality infrastructure, thereby strengthening trust in national-branded goods and enhancing their global competitiveness in a fundamental and sustainable manner.

Secondly, it is essential to establish a trilateral coordination mechanism between the state, businesses, and the overseas Vietnamese community, with clearly defined roles and an efficient operating structure. This mechanism would form the foundation of a “whole-of-nation integration strategy”, in which the state plays a facilitating and promotional role, businesses serve as the production and innovation drivers, and overseas Vietnamese act as cultural and commercial ambassadors in the host markets. If institutionalised into a national strategy, this mechanism could vastly expand Viet Nam’s global brand promotion network while unlocking the full potential of the global Vietnamese diaspora as “soft ambassadors” of economic integration and national branding.

Thirdly, greater support is needed for businesses in registering intellectual property rights and protecting geographical indications and trademarks in high-end markets. Amid increasingly fierce global competition, legal protection of brands and products is a vital “shield” against the infringement or misappropriation of Vietnamese goods. Special attention should be given to signature agricultural products, processed foods, consumer goods, and handicrafts, which are rich in cultural identity and high value-add potential. Furthermore, legal protection must go hand in hand with professional brand communication strategies to increase recognition, elevate brand stature, and build lasting consumer trust in international markets.

These three strategic pillars are the foundation for enabling Vietnamese brands not only to overcome stringent technical barriers but also to advance confidently on the path of comprehensive global integration. It is the journey of an emerging economy in asserting its identity, capability, and prestige, not merely to blend into the global flow but to create distinctive, sustainable, and proud marks on the world stage.

If global integration is a long journey, then high-standard markets are its steepest slopes — where brand resilience is tested most rigorously.

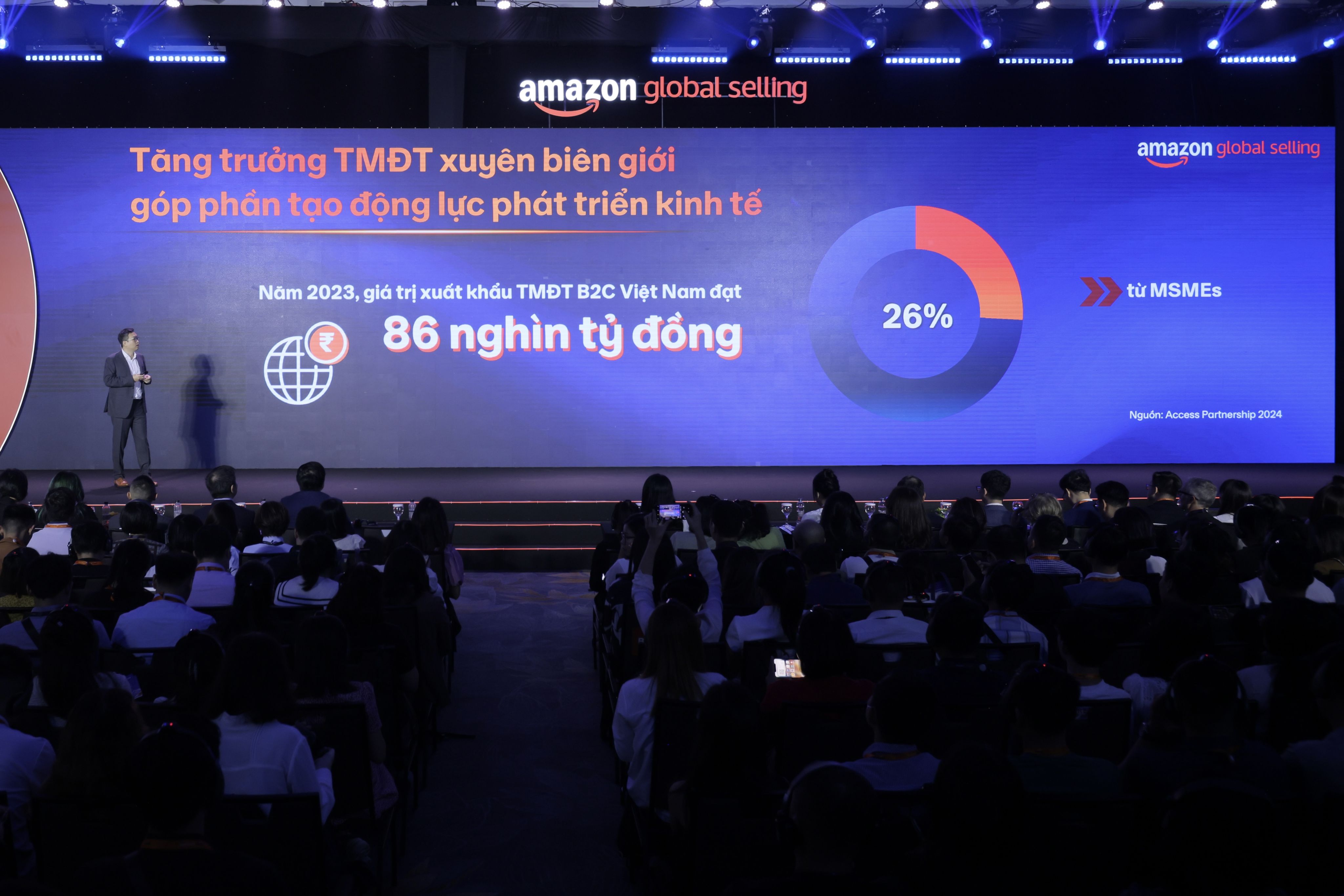

Over the past five years, the number of products sold by Vietnamese sellers through cross-border e-commerce platforms like Amazon has increased significantly.

Over the past five years, the number of products sold by Vietnamese sellers through cross-border e-commerce platforms like Amazon has increased significantly.

Yet they are precisely where Vietnamese brands have the opportunity to be positioned on par with developed countries, not only through quality but also thanks to long-term strategy, adaptability, and a commitment to sustainable development.

The presence of a Vietnamese coffee cup in Paris, a Soi Ha pomelo in London, or a “Made in Viet Nam” AGV operating in a Japanese factory is more than a business success story, it is a testament that Vietnamese goods can embody cultural value, social responsibility, and the courage of national integration on the global stage.

Published: June 29, 2025

Content: Thach Vu, Trung Hieu, Kim Linh, Khanh Lan, Minh Phuong

Design: Thuy Linh

Photos: NDO, Viet Nam’s Trade Offices in India and the Republic of Korea