National Trade Promotion: the extended arm of global integration

In the context of deepening global integration, Viet Nam’s network of Trade Offices abroad plays a vital role — not only as a commercial bridge but also as a “trailblazer” helping businesses conquer international markets. Among these markets, India — home to nearly 1.4 billion people with a rapidly growing middle class — has seen significant progress thanks to trade promotion efforts, especially in sectors such as agriculture, spices, electronics, and supporting industries.

India: a vast but turbulent blue ocean

As global supply chains are being restructured and emerging economies accelerate their growth, India has become a strategic target market for Vietnamese exports. With a population of 1.46 billion, a young demographic structure, a fast-expanding middle class, and increasing demand in both consumption and manufacturing, this South Asian country presents itself as a vast and high-potential but turbulent "blue ocean.

Viet Nam is making good use of its opportunities for cooperation with India, which is currently Viet Nam’s 8th largest trading partner, while Viet Nam ranks 17th among India’s global partners and 4th within ASEAN, following Singapore, Malaysia, and Indonesia.

According to Bui Trung Thuong, Viet Nam's Trade Counsellor in India, Viet Nam is making good use of its opportunities for cooperation with India, which is currently Viet Nam’s 8th largest trading partner, while Viet Nam ranks 17th among India’s global partners and 4th within ASEAN, following Singapore, Malaysia, and Indonesia. In 2024, two-way trade reached nearly 15 billion USD, up 4.5% from 2023. Of this, Viet Nam's exports to India totalled 9.06 billion USD (up 7.6%), while imports stood at 5.83 billion USD (a slight 0.6% decrease).

Entering 2025, this positive momentum has continued. In the first five months, bilateral trade hit 6.52 billion USD, up 9.2% year on year. Notably, Viet Nam's exports to India surged to 4.1 billion USD, a 16.6% increase, while imports decreased to 2.37 billion USD — resulting in a trade surplus of 1.77 billion USD, up 53.6% year on year.

Beyond growth in volume, Viet Nam’s export structure to India has also improved. Electronics remain the leading export category. In 2024 alone, Viet Nam’s electronics exports to India reached approximately 2.5 billion USD. In the first five months of 2025, mobile phones and components topped the chart with 960 million USD (up 30%), accounting for 23% of total exports. Computers, electronic products, and components followed with 602 million USD, making up 14.5%.

At the Agritechnica Asia Vietnam 2025

At the Agritechnica Asia Vietnam 2025

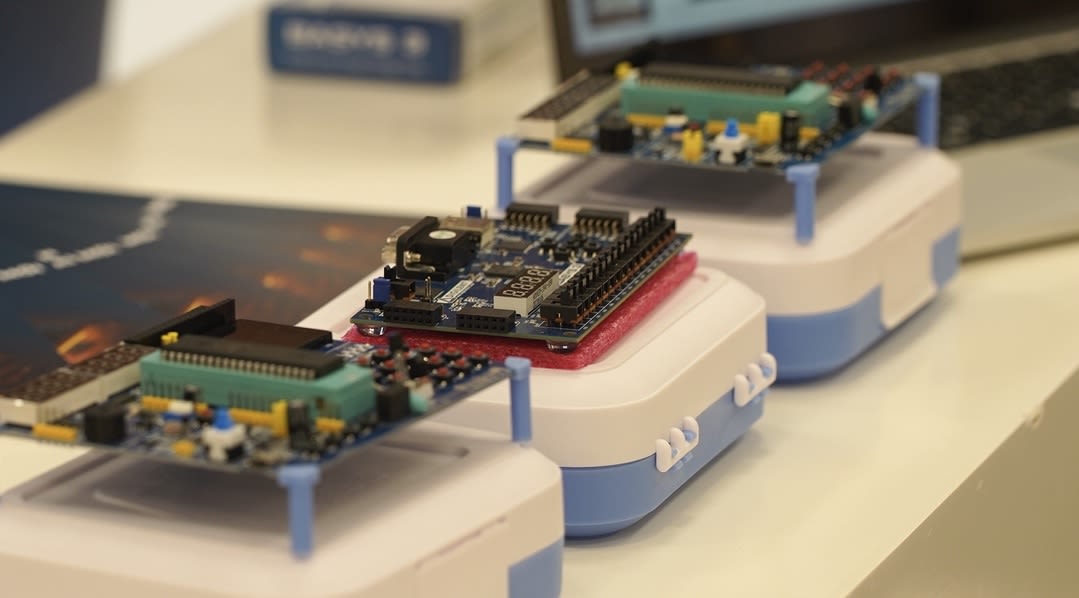

Vietnamese technology products introduced

Vietnamese technology products introduced

Despite its potential, the Indian market, which is truly a “blue ocean” with undercurrents, remains a complex market for Vietnamese businesses.

First, India’s complex technical standards and non-tariff barriers pose a constant challenge. Imported goods must comply with strict regulations on quality, safety, and traceability. Mandatory certifications from agencies like the Bureau of Indian Standards (BIS) and the Food Safety and Standards Authority of India (FSSAI) are time-consuming and often opaque, leading to high costs and delayed deliveries. In 2024, India temporarily halted BIS certification, leaving many Vietnamese shipments stuck at ports.

India has also ramped up trade defence measures to protect its domestic industries. Since late 2024, the country has launched anti-dumping, countervailing, and safeguard investigations on Vietnamese goods such as steel, nylon yarn, calcium carbonate filler, tempered glass, and medical gloves. These actions not only increase costs but also erode competitive advantages and prolong customs clearance.

Regarding logistics, transportation remains a major bottleneck. Although a direct sea route is now available, shipping costs remain high, and service reliability is still inconsistent. The long distance, extended transit time, and dependence on transshipment hubs like Singapore and Malaysia are particularly disadvantageous for perishable goods such as fresh produce and seafood.

Cultural differences and language barriers also pose significant challenges. Many Vietnamese businesses lack international negotiation skills, have limited proficiency in the English language, and insufficient understanding of the local customs and consumer behaviours. As a result, trade disputes have become increasingly common.

Bilateral trade also faces lingering institutional challenges. The upgrade of the ASEAN-India Trade in Goods Agreement (AITIGA) has been slow. India remains concerned about Vietnamese goods with Chinese origins, prompting stricter inspections. On the flip side, Viet Nam has yet to allow imports of Indian buffalo meat or open its pharmaceutical market to Indian firms, which has been hindering reciprocal market access for agricultural products.

Finally, the most significant challenge may lie in business mindset. Many Vietnamese enterprises still do not view India as a long-term strategic market. Market research is limited, partnerships with local firms remain weak, and operations rely heavily on short-term orders. Weak competitiveness in product design, quality, and adaptability is hampering efforts to meet the rising expectations of Indian consumers.

From trade promotion to national brand building

According to Bui Trung Thuong, with a well-developed strategy, Vietnamese products such as agricultural goods, electronics, and wooden furniture can fully establish a strong and sustainable brand presence in India — a market with high purchasing power, a growing preference for green consumption, and increasing demand for traceability, quality, and brand identity.

Currently, agricultural products and spices from Viet Nam are making a significant mark. Viet Nam is the largest cinnamon supplier to India, accounting for 85% of its import market share. Pepper exports surged by 90% in the first five months of 2025. Vietnamese coffee brands like G7 and Trung Nguyen have started penetrating the Indian market through e-commerce platforms such as Amazon and Flipkart. With India’s expanding middle class showing a strong preference for organic products with clear origin and appealing packaging, Vietnamese agricultural goods hold vast potential to become national brands, provided that investments are made in geographical indication, traceability, packaging, and strategic marketing.

In the electronics sector, Viet Nam has become a key manufacturing hub in the region, particularly for products such as phones, components, circuit boards, and screens. In the first five months of 2025 alone, phone and component exports reached 960 million USD, accounting for 23% of Viet Nam’s total exports to India. As India accelerates its "Make in India" initiative, Viet Nam has the opportunity to become a trusted supplier of electronic components by leveraging trade agreements, enhancing production capacity, and standardising technical quality.

The wood and wood products industry is also emerging as a promising candidate for brand development. Viet Nam is currently the third-largest wood product supplier to India (after China and Malaysia), with export value having increased by nearly 300% over the past year. Key products include MDF, plywood, and veneer boards, catering to the mid-to-high-end urban interior market in cities like Mumbai, Delhi, and Bangalore. With proper investment in design, technical standards, and branding aligned with modern and eco-friendly interior trends, Vietnamese wood products have strong long-term potential.

Introducing Vietnamese coffee products

Introducing Vietnamese coffee products

Vietnamese enterprises make their mark on the global market

Vietnamese enterprises make their mark on the global market

Vietnamese technology products showcased

Vietnamese technology products showcased

With a well-developed strategy, Vietnamese products such as agricultural goods, electronics, and wooden furniture can fully establish a strong and sustainable brand presence in India — a market with high purchasing power, a growing preference for green consumption, and increasing demand for traceability, quality, and brand identity.

During his tenure in India, Bui Trung Thuong has praised several Vietnamese businesses for successfully building brand recognition and trust in the market. In the services sector, airlines such as Vietnam Airlines and Vietjet Air are widely recognised for their stable flight schedules, tourism connectivity, and quality services. Vietravel has also been a pioneer in bringing Indian tourists to Viet Nam.

In terms of goods, VinFast has made a bold impression by investing in an electric vehicle manufacturing plant in Tamil Nadu, demonstrating long-term commitment and strategic vision. Vietnamese dragon fruit are now widely available in major retail chains across Maharashtra, Gujarat, and Delhi, while frozen pangasius and spices such as cinnamon, star anise, and black pepper are well regarded for their quality and transparent sourcing.

Viet Nam’s electronics exports, including those produced by FDI companies like Samsung, continue to achieve strong and steady growth, reinforcing Viet Nam’s position in India’s high-tech supply chain.

Vietnamese businesses promote their products in India.

Vietnamese businesses promote their products in India.

Vietnam participates in Uttar Pradesh International Trade Show (UPITS).

Vietnam participates in Uttar Pradesh International Trade Show (UPITS).

Vietnam participates in Uttar Pradesh International Trade Show (UPITS).

Vietnam participates in Uttar Pradesh International Trade Show (UPITS).

Rebuilding a brand must begin with quality and strategy

According to Bui Trung Thuong, establishing a sustainable brand presence in a vast and competitive market like India requires a comprehensive strategy that integrates government policies, proactive business engagement, and the coordinating role of industry associations and local authorities.

First and foremost, businesses need to prioritise product quality and value addition, investing in packaging, design, traceability, and brand identity. A national brand can only be truly recognised when it is associated with consistent quality, safety, and alignment with local consumer preferences.

"Establishing a sustainable brand presence in a vast and competitive market like India requires a comprehensive strategy that integrates government policies, proactive business engagement, and the coordinating role of industry associations and local authorities."

Vietnamese silk products showcased in India.

Vietnamese silk products showcased in India.

Vietnamese handicraft products showcased in India

Vietnamese handicraft products showcased in India

India is not only a “strategic gateway” for Vietnamese exports, but also a major “litmus test” for the broader national brand-building strategy in emerging, competitive, and diverse markets like the Asia-Pacific.

India is not only a “strategic gateway” for Vietnamese exports, but also a major “litmus test” for the broader national brand-building strategy in emerging, competitive, and diverse markets like the Asia-Pacific.

From the government side, efforts should focus on promoting trade, supporting the recognition of technical standards, and facilitating trademark and geographical indication protection in India. Effective leveraging of free trade agreements, such as the ASEAN-India FTA (AIFTA), will serve as a key tool to enhance competitiveness.

The role of trade missions is also indispensable. In recent years, the Viet Nam Trade Office in India has worked closely with Vietnamese businesses through supporting participation in major exhibitions such as World Food India and UPITS, organising Viet Nam Week and sector-specific B2B seminars, and facilitating trade matchmaking events. Additionally, cultural and tourism promotion activities like “Viet Nam Day in India”, collaborations with Bollywood, and social media campaigns have softly but effectively boosted Viet Nam’s brand recognition.

In reality, many Vietnamese businesses still underestimate the Indian market, conducting limited market research, neglecting post-sale services, and lacking long-term strategic planning. Thuong shared that some Vietnamese food processing companies shipped products to India without understanding FSSAI standards or proper packaging regulations, leading to customs delays. In another case, a light industry firm signed an online contract without verifying the partner’s credibility, resulting in a trade dispute.

This highlights the critical importance of preparation. Businesses must actively study the market, its standards, consumer behaviour, and local laws — while also leveraging support from trade offices and official promotion channels to connect with the right partners, reduce costs, and avoid unnecessary risks.

India is not only a “strategic gateway” for Vietnamese exports, but also a major “litmus test” for the broader national brand-building strategy in emerging, competitive, and diverse markets like the Asia-Pacific. The lessons learned from overcoming technical barriers, investing in quality and traceability, to fostering effective partnerships between the government, businesses, and diplomatic missions can be applied to other global markets.

Viet Nam’s success in capitalising on opportunities in India proves that only when Vietnamese products embody sustainable value, cultural identity, and clear positioning can they thrive amid the rapid and complex dynamics of global trade.

Published: June 28, 2025

Content: Thach Vu, Trung Hieu, Kim Linh, Khanh Lan, Minh Phuong

Design: Thuy Linh

Photos: NDO, Vietnam’s Trade Offices in India and the Republic of Korea