Over-reliance on bank credit

The Ministry of Finance’s reports show that in 2024, nearly 930 trillion VND was raised from the capital market, marking a 30% increase from 2023 and accounting for 25% of total social investment. Meanwhile, foreign direct investment (FDI) inflows reached 25.4 billion USD, the highest ever recorded, driving GDP growth to 7.09% and pushing Vietnam’s economy to 476.3 billion USD, ranking 33rd globally.

Despite these impressive numbers, Minister of Finance Nguyen Van Thang admitted that Vietnam’s capital mobilisation channels remain underdeveloped. The stock market, for instance, faces numerous challenges, with an increasing number of foreign investors holding only 0.5% of total trading accounts. The operations of securities investment funds have not yet fully realised their potential. The total asset value of investment funds remains modest, representing only 6.5% of GDP, compared to 21% in Thailand and 52% in Malaysia.

Shantanu Chakraborty, Country Director of the Asian Development Bank (ADB) in Vietnam, warns that the country’s economy leans too heavily on bank credit while alternative funding sources such as investment funds, equity issuance, and external financing have yet to reach their full potential.

The trend is evident in banking data. According to the State Bank of Vietnam, total bank credit grew by around 14% in 2023, higher than GDP growth. This indicates that bank credit remains the primary source of financing for the economy. Small and medium-sized enterprises (SMEs) rely overwhelmingly on bank loans, to sustain their operations. Around 70-80% of SMEs borrow capital from banks, while only a small percentage can raise capital from other sources such as bond issuance, stock issuance, or private investors. A significant portion of total outstanding credit is allocated to real estate projects, accounting for approximately 20-30%.

The data above shows that economic investment activities rely heavily on bank credit, particularly in sectors like real estate and small and medium-sized enterprises (SMEs) engaged in production and business. While bank credit is an important capital source, excessive dependence can create long-term risks, especially when credit expands too rapidly or during economic downturns.

Moreover, many foreign investors point out obstacles such as complicated administrative procedures and unpredictable, short-term policies, which make them hesitant to invest in Vietnam.

Policy decisions in new context

Nitin Kapoor, Vice Chairman of the Vietnam Business Forum (VBF) Alliance, asserts that in the current context, policy consistency, clarity, transparency, and predictability are of utmost importance. He notes that these remain Vietnam’s weak points and must be urgently addressed.

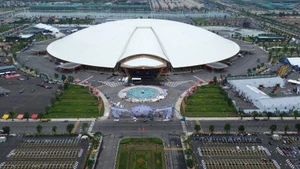

|

| Businesses find it difficult to access bank loans. Photo: NGUYET ANH |

Jeong Ji-Hoon, Vice Chairman of the Korean Business Association in Vietnam, highlighted that the Republic of Korea remains Vietnam’s top investor, with over 10,000 projects and a total investment of 91 billion USD. However, he stressed that to become more attractive to investors, Vietnam must ensure greater transparency in tax policies, maintain consistent policy enforcement nationwide, and accelerate the digitalisation of administrative procedures to reduce processing times.

Minister of Finance Nguyen Van Thang emphasised the importance of capital mobilisation as Vietnam aims for robust economic growth to enter a new era. To facilitate this, the Ministry of Finance is developing a range of targeted strategies to attract investment in the new era.

Vietnam is set to accelerate institutional reforms, establishing a transparent and predictable investment climate, fostering private sector growth, and prioritising investment in key areas such as science and technology, innovation, digital transformation, and green transformation. Administrative reforms will continue enhancing public service delivery, safeguarding business freedom, and ensuring equitable competition between domestic and foreign enterprises.

The Ministry of Finance is leading efforts to propose comprehensive amendments to the State Budget Law, Corporate Income Tax Law, and Personal Income Tax Law to the Government and National Assembly. Additionally, revisions will be made to seven other laws, including the Bidding Law, Investment Law, PPP Law, Public Investment Law, Public Asset Management Law, Customs Law, and Import-Export Tax Law, to unlock financial resources for economic growth.

Another key solution is expanding and deepening the capital market. This entails improving corporate governance and risk management in public and listed companies, while gradually adopting international accounting and financial reporting standards to enhance transparency and information quality for investors, thereby improving the quality of market supply.

The Ministry of Finance aims to boost investment funds by diversifying fund types, stock indices, and financial products that cater to investors’ needs and risk appetites. It will also expand distribution channels and encourage fund management firms to establish new funds. Investment fund tax policies will be reviewed to align with their true nature, fostering investment through professional financial institutions.

To attract foreign direct investment (FDI), Minister Nguyen Van Thang stated that Vietnam will strengthen public-private partnerships with corporations and investment funds that have sustainable capital, effective operations, strong management experience, and proven business models. The priority will be given to attracting investment in key infrastructure projects, artificial intelligence, semiconductors, scientific and technological advancements, innovation, digital transformation, and renewable energy. Additionally, selective investment policies will favour projects that create strong economic links between foreign and domestic enterprises, enhancing Vietnamese businesses’ global competitiveness.