Preventing countries from debt defaults is becoming an urgent issue and supporting countries to overcome debt crises will be a priority in discussions at the annual meeting of the World Bank (WB) and the International Monetary Fund (IMF), to be held in Marrakech, Morocco next week.

The crisis caused by the COVID-19 pandemic and the conflict in Ukraine has pushed many countries to the brink of default. High interest rates, investors’ risk aversion and escalating borrowing costs have caused some developing countries to fall into debt. In Europe, Ukraine stopped paying its debts after the outbreak of conflict. The world’s leading organisations estimate the cost of rebuilding post-conflict Ukraine to be at least 1 trillion EUR, of which the IMF expects that Ukraine needs about 3-4 billion USD per month to maintain Government operations.

In the Middle East, Lebanon defaulted on its debt for the first time in 2020 and there are few signs that the Lebanese economy is recovering. Last September, the IMF welcomed the changes of the Central Bank of Lebanon but said that Lebanon needed extensive reforms in the context of a difficult and uncertain economic outlook. The IMF warns that continued difficulties could push Lebanon’s public debt to 547% of GDP, by 2027.

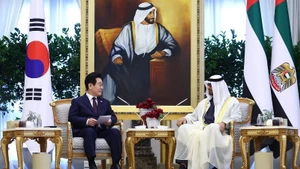

Meanwhile, in Asia, Pakistan needs up to 22 billion USD to repay foreign debt and pay bills for fiscal year 2024, in the context of record high inflation and interest rates accompanied by heavy losses, after the historic floods in 2022. Last June, the IMF approved a 3 billion USD bailout package for Pakistan, along with 3 billion USD in cash support from Saudi Arabia and the United Arab Emirates (UAE).

However, observers continue to be skeptical about the resilience of the Pakistani economy without large amounts of support. Sri Lanka defaulted on its debt in May 2022, as the COVID-19 pandemic hit the tourism industry, causing the government to run out of money to import food, petrol and medicine. Sri Lanka announced a debt settlement plan in June and made much progress. The IMF will likely delay the next 2.9 billion USD bailout package for Sri Lanka in the context of budget revenue shortages.

In Africa, even developed countries in the North African region are facing the risk of serious debt crises. Consecutive shocks since 2011 have pushed the Tunisian economy into a comprehensive crisis. Credit rating agencies say that Tunisia may default on its debt, in the context of European bonds worth 500 million USD, due this month.

In eastern Africa, political instability and the COVID-19 pandemic have strongly impacted the Ethiopian economy. In early 2021, the Ethiopian government proposed restructuring under the G20 Common Framework for Debt treatment beyond the Debt Service Suspension Initiative. Ghana defaulted on most of its foreign debt in December 2022 and became the fourth country to seek economic restructuring under the G20 Common Framework.

Ghana received a 3 billion USD bailout package from the IMF last May and said that the process of restructuring 30 billion USD of foreign debt and domestic debt took place quite quickly. Public debt in Kenya reached 67.4% of GDP by the end of 2022, causing a high risk of falling into a debt crisis. This country is negotiating with the African Development Bank and the WB for budget support, in the context of having to repay European bonds worth 2 billion USD, in 2024.

Efforts deployed by the WB, IMF or G20 to reduce the debt burden in low-income countries are considered insufficient. According to the UNCTAD leader, this process is happening very slowly and many countries still need help. Therefore, it is necessary to establish better mechanisms to resolve the debt problem more quickly.

However, the scale of the current debt settlement system remains small compared to the challenges being faced. Meanwhile, the World Bank grows much slower than the global economy, so it has many difficulties meeting arising needs and solving the debt crisis for developing countries.