The State Bank of Vietnam (SBV) reported that credit last year grew 13.78% from the end of 2022. Due to the Lunar New Year holiday and the economy’s limited capital absorption, credit pumped into the economy as of February 29 this year fell 0.72% from the end of 2023.

However, the decline in February slowed down compared to January’s, the central bank noted, adding that with abundant liquidity and much room for credit growth, credit institutions have favourable conditions to supply capital for the economy.

In his speech, PM Chinh thanked businesses and banks for joining hands with the entire Party, political system, and people to weather difficulties and challenges and obtain achievements in most of the areas last year, with the macro-economy being kept stable, inflation placed under control, growth boosted, major balances guaranteed, and social security improved. The socio-economic situation continued recovering and growing well in the first two months of 2024.

As numerous difficulties and challenges are predicted to linger on this year, the Party, State, Government, and the PM have issued many concrete and practical directions, mechanisms, and policies to ensure the banking system’s sustainable and safe development. However, the economy is still encountering problems, shortcomings, difficulties, and challenges, he pointed out.

The government leader noted that credit growth in January - February declined compared that in late 2023. Meanwhile, deposits remained considerable, with 14 quadrillion VND (566.9 billion USD) put into bank accounts during the period. However, enterprises are still facing shortages of capital for production and business activities, lending interest rates stay high, and non-performing loans tend to increase. The settlement of poor-performing commercial banks is still slow while some credit packages have yet to prove effective.

Stressing the special importance of 2024 to the implementation of the five-year plan 2021 - 2025, PM Chinh said general targets include fostering growth, keeping macro-economic stability, controlling inflation, guaranteeing major economic balances, and ensuring social security. In particular, this year’s gross domestic product (GDP) growth is targeted at 6 - 6.5%, the consumer price index (CPI) growth 4 - 4.5%, the rate of non-performing loans under 3%, and credit growth 15%.

Urging strong determination and efforts to realise the targets, he ordered enhancing credit access and absorption, credit quality, governance capacity, interest rate transparency and “black credit” fight, along with supervision, examination, and risk prevention.

|

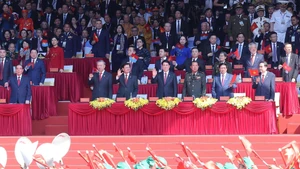

| An overview of the conference. (Photo: NDO) |

At the same time, the parties concerned must reduce loan interest rates, costs, administrative procedures, bureaucracy, as well as negative phenomena and group interest. They also need to create breakthroughs in terms of digitalisation, service quality, human resource quality, banking infrastructure, and services for production and business activities, he demanded.

PM Chinh asked the SBV to keep a close watch on the international and domestic situation to govern the monetary policy in a proactive, flexible, timely, and effective manner.

The bank needs to ensure the harmony between interest rates and exchange rates, effective credit growth, and safety for banking activities and credit institutions. In addition, it needs to boost inspection, examination, and supervision of loan supply by credit institutions, he went on.

The government leader also asked credit institutions to strongly carry out measures for promoting credit growth; channelling capital into production and business activities, priority areas, and growth drivers; and strictly controlling credit for high-risk fields.

He also assigned tasks to relevant ministries and localities, expressing his belief that difficulties and challenges will be surmounted and the tasks and targets for 2024 fulfilled with the best possible results.