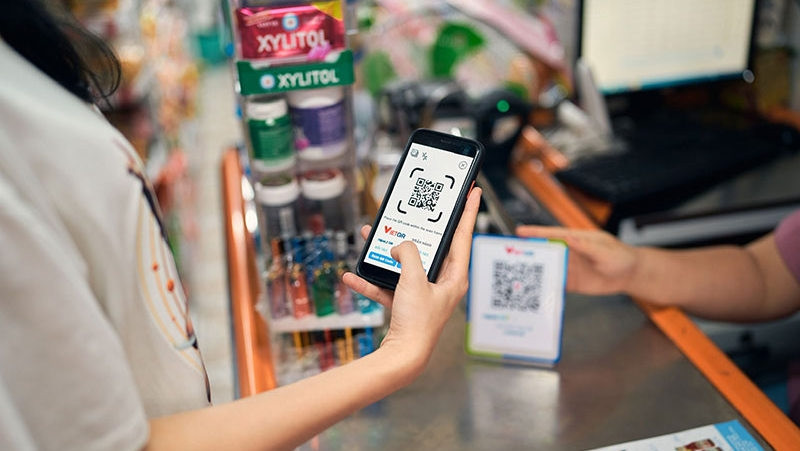

Today instead of cash, consumers are turning to more practical methods such as chip-mounted bank cards, QR code payment, electronic wallets and mobile banking apps.

According to Le Van Tuyen, deputy head of payment at the State Bank of Vietnam (SBV), payment activities of people and organisations, especially young people have reached the global technological standards. Electronic payment methods combined with advanced encryption and authentication solutions are making them increasingly safe and secure.

Notably, recent years have seen a strong push for electronic payment in the government’s delivery of public services, in which one of the important solutions was the launch of the National Public Service Portal in 2019. Many public services are now available on the portal, providing convenience and swiftness for people.

According to the Deputy Director of Napas, which links payment systems in Vietnam, the company has completed connecting the payment infrastructure with 48 localities and 15 government agencies to provide online payment services for five groups of public services on the portal.

To promote cashless payment in Vietnam, the SBV has taken various measures, one of which is finetuning the legal framework, mechanism and policy. Under the central bank’s digital transformation plan, Vietnam aims to develop the model of digital banks to increase service offerings, enhance customer experience and realise the goals of financial inclusion.

To encourage customers to engage in more cashless payment activities, it is also necessary to focus on risk management. The standards of Vietnamese banks are now similar to international standards, so the task of risk prevention and security must come first to ensure the rapid and sustainable development of the payment market.

Banks must meet global security standards and strictly comply with international regulations, especially in preventing card forgery when international travel rebounds following Vietnam’s full opening.