Globally, consumers are returning to brick-and-mortar stores as destinations for shopping, experiences, and interaction. In response, shopping centres have been effectively leveraging event diversification as a key tool to maintain and enhance their attractiveness.

Seasonal and festive decorations (summer, back-to-school, Mid-Autumn Festival), family and children’s workshops, and special exhibitions or product launch events have drawn additional visitors for sightseeing, photography, and social engagement. These have become effective, large-scale strategies employed by developers to sustain appeal and differentiate themselves from other centres.

According to Savills Viet Nam’s Q3 2025 data, visitor traffic varies markedly based on the age of shopping centres. For example, newer centres (operating for 1–3 years) remain in their growth phase, recording impressive traffic increases of 35–40% compared with the same period in 2024. Meanwhile, long-established and well-positioned centres also saw growth, though at a more moderate rate of 15–30% year-on-year.

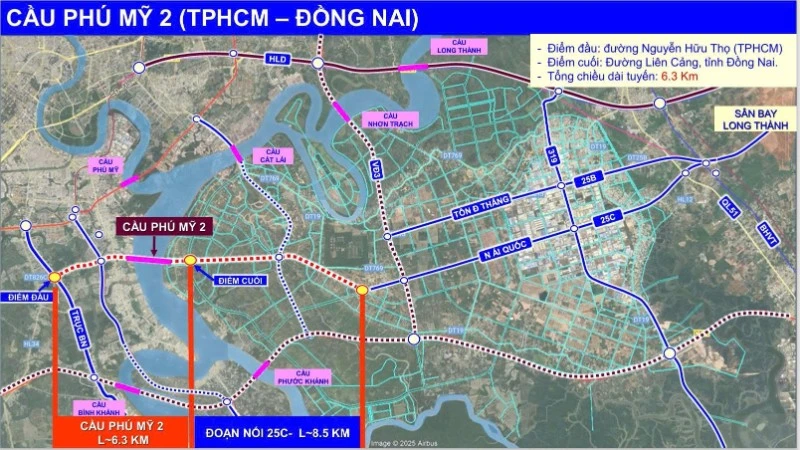

This rise is attributed to internal efforts such as improving shopping environments, welcoming new brands, and developing VIP customer care programmes, along with macroeconomic factors such as an increase in international visitors and regional infrastructure development.

This trend also reflects a major shift in investment and operational thinking: retail is now viewed as an operational asset class—one that requires close integration between operations, technology, brand management, and deep consumer insight. Modern shopping centres must be managed as complete ecosystems.

Further expansion by retail brands in Viet Nam is expected, supported by favourable macroeconomic factors related to cost and labour. According to the Savills Property Price Index (SPPI) Q2 2025 report, construction costs have remained stable.

Data from the Ho Chi Minh City Department of Construction indicated that the construction price index in Q4 2024 held steady at 119 points, while the building materials price index dropped by 2 points year-on-year due to declines in the prices of several materials.

Viet Nam’s labour force grew by 1% in Q2 2025, reaching 53 million people, with the services sector (directly linked to retail) recording the strongest increase of 472,000 workers. This demonstrates a plentiful and positively shifting workforce, ready to meet market demand.

Overall, consumers increasingly visit shopping centres for leisure, entertainment, dining, and shopping—particularly during festive periods—thanks to the convenience of integrated destinations. Viet Nam’s advantages lie in its young, dynamic, and trend-driven population, coupled with reasonable operating costs, positioning the country as a strategic destination for international brands.

Visitor traffic at shopping centres in Ho Chi Minh City is expected to continue its upward trajectory in Q4 2025, coinciding with numerous key end-of-year milestones.