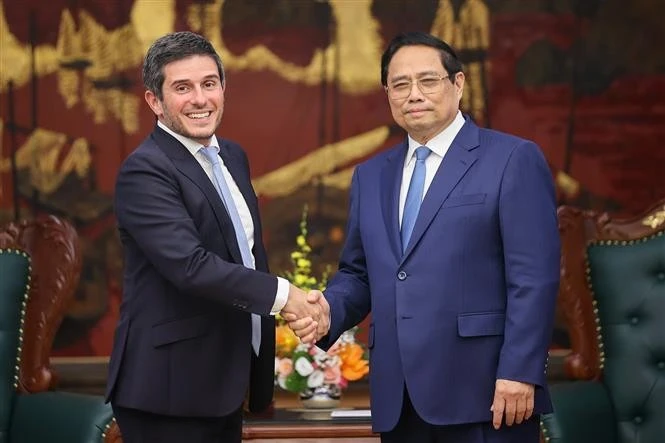

During a reception in Ha Noi for FTSE Russell’s Global Head of Equity and Multi Asset Gerald Toledano, PM Chinh called modernising Viet Nam’s capital markets a linchpin for mobilising private investments at home and abroad.

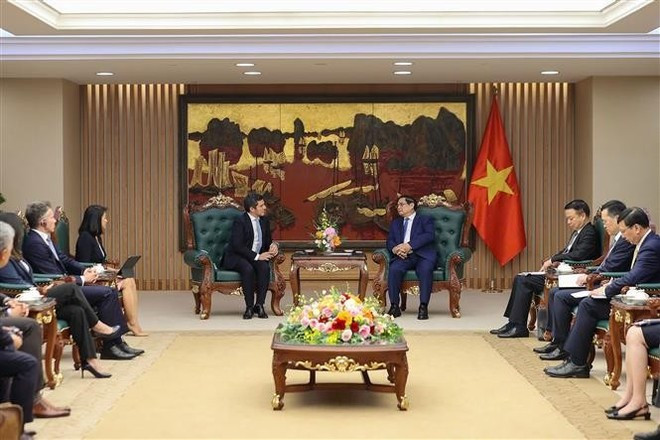

He highlighted Viet Nam’s aggressive push for stock market reforms to foster a transparent, investor-friendly environment. The Government has already submitted a revised Securities Law to the National Assembly and a resolution to establish an international financial centre.

The PM urged FTSE Russell to support Viet Nam’s efforts by delivering objective and comprehensive assessments of its economy and capital markets, sharing international best practices, and aiding the building of a modern legal and regulatory framework. He also sought assistance in upgrading market infrastructure, training quality financial professionals, and creating an international financial hub to draw global capital.

In response, Toledano praised Viet Nam’s reform momentum, noting that its stock market, now the most liquid in ASEAN, has surpassed those of Thailand and Singapore.

He reaffirmed FTSE Russell’s commitment to aiding Viet Nam’s emerging market bid, pledging to back its economic goals through 2045 and share its progress to global investors.