The role of the world's leading exporter

In recent years, Vietnam has been known as the second largest coffee supplier in the world, especially for Robusta, the country being the dominant supplier with about 40% of global market share.

However, many debates have broken out to discuss the fact that the country has not yet taken full advantage of its current position on the world coffee map, affirming the importance of Vietnamese coffee in the global coffee supply chain.

In the first two months of 2023, the price of Robusta traded on ICE London began a new uptrend as Vietnam was the only large supply available in the market.

The restriction of sales by farmers before and during the Lunar New Year caused a sharp drop in exports in January and the first two months of the year.

According to statistics from the General Department of Customs, Vietnam’s coffee exports in January reached 160,000 tonnes, a sharp decrease of nearly 40% compared to the same period in 2022 and accumulated exports in the first 2 months of the year recorded a decrease of nearly 8% over the first two months of last year.

Both domestic and international analysts said this is also the main reason for the increase in the price of Robusta. This is a signal showing the role of Vietnam in the world Robusta market.

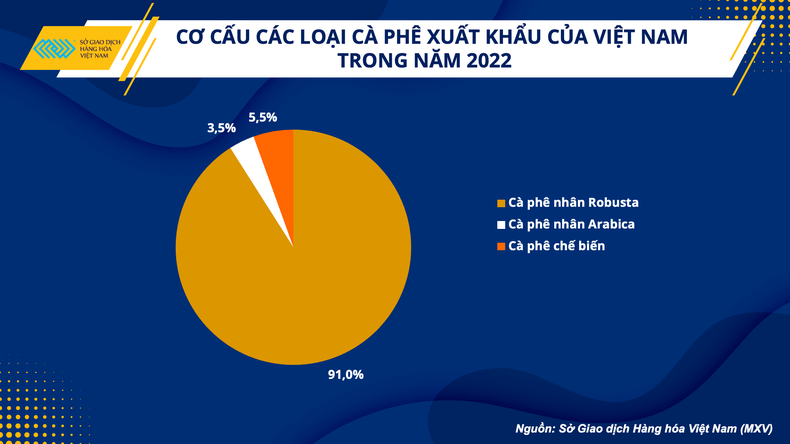

However, this importance only comes from the volume of Vietnam's raw exports, which brings low added value in the value chain of the coffee industry.

Regarding other aspects such as the value and sustainable development of the coffee industry, the country still seems not to have placed the right focus nor shown the right position.

Despite being the world's second largest exporter, Vietnam currently has no coffee brands in the group of ten major coffee brands. The competition from large coffee shops has repeatedly plagued Vietnamese coffee brands in the domestic market, such as the arrival of Starbucks in recent years.

Enhancing the value of exported coffee to affirm its current position on the world map

As mentioned above, most of Vietnam's exported coffee is in raw and unprocessed form with low added value. Therefore, the main measure to solve the problem needs to start by enhancing the value of exported coffee by shifting from the export of raw coffee to products that bring higher added value such as processed and specialty coffee.

|

| Structure of coffee exports of Vietnam in 2022 |

Not stopping at fine processing to enhance value, the introduction of cultural values into each coffee product to make the specials for Vietnamese coffee is also a solution that has been receiving great attention. At a conference discussing measures to increase the value of Vietnamese coffee, Minister of Agricultural and Rural Development Le Minh Hoan said coffee is a cultural identity and to build its brand, businesses must reposition and know how to tell a story to inspire the emotions of consumers.

Boosting domestic potential for sustainable development

In addition to boosting exports to affirm Vietnam's position in the world market, an extremely important problem for the Vietnamese coffee industry is to focus on exploiting the domestic potential.

As a country of nearly 100 million people with more than 300,000 small and large coffee shops in operation with an annual growth rate of about 2% during the 2016-2022 period, the demand for domestic coffee consumption in Vietnam has been showing great promise.

Moreover, the rate of coffee consumption per capita in Vietnam is at a very low level, only 2 kg per person per year, much lower than Brazil with 5.8kg per person per year or top importing countries such as the US with 4.2kg per person per year and Finland with 12kg per person per year.

The average rate of domestic coffee consumption has only reached about 10% in the last 10 years, much lower than that of major exporting countries such as Brazil and Indonesia where it ranges from 25% to 30% of coffee production. This shows a large space in promoting domestic coffee consumption, contributing to the development of Vietnam's coffee industry.

Especially, in the context of the international market experiencing great fluctuations in coffee consumption demand due to concerns about the wide-ranging economic recession and stricter requirements on the quality and origin of coffee from foreign markets, the priority for the development of the domestic market is considered a foundation to help Vietnam's coffee industry more stable against the turbulence of the international market.

Thus, as the world's second largest coffee exporter in general, Vietnam has partly shown its importance to global supply as well as to price trends.

However, the affirmation of Vietnam’s position does not stop there. It is crucial to further strengthen its added value in the international market while focusing on exploiting the development prospects of the domestic market to increasingly improve the important position of Vietnamese coffee on the world coffee map.