Difficulties abound

In 2025, Viet Nam recorded several bright spots in institutional reform, improvements to the business environment and export growth. However, it was also widely regarded as a highly challenging and volatile year, as businesses were operating under difficult conditions, constrained by limited resources while simultaneously grappling with risks stemming from non-traditional trade barriers and intense market competition.

The textile and garment sector is a typical example, as weakening global consumer demand, competition from low-priced products and rising input costs steadily eroded profit margins.

Similarly, the fisheries sector is facing multiple obstacles, including the EU’s warning on illegal, unreported and unregulated fishing, high production costs, reciprocal tariff issues, and the US Marine Mammal Protection Act (MMPA), which takes effect on January 1, 2026 and bans the import of certain Vietnamese seafood products. This poses a major challenge, given that the US is a key market for Viet Nam’s fisheries exports.

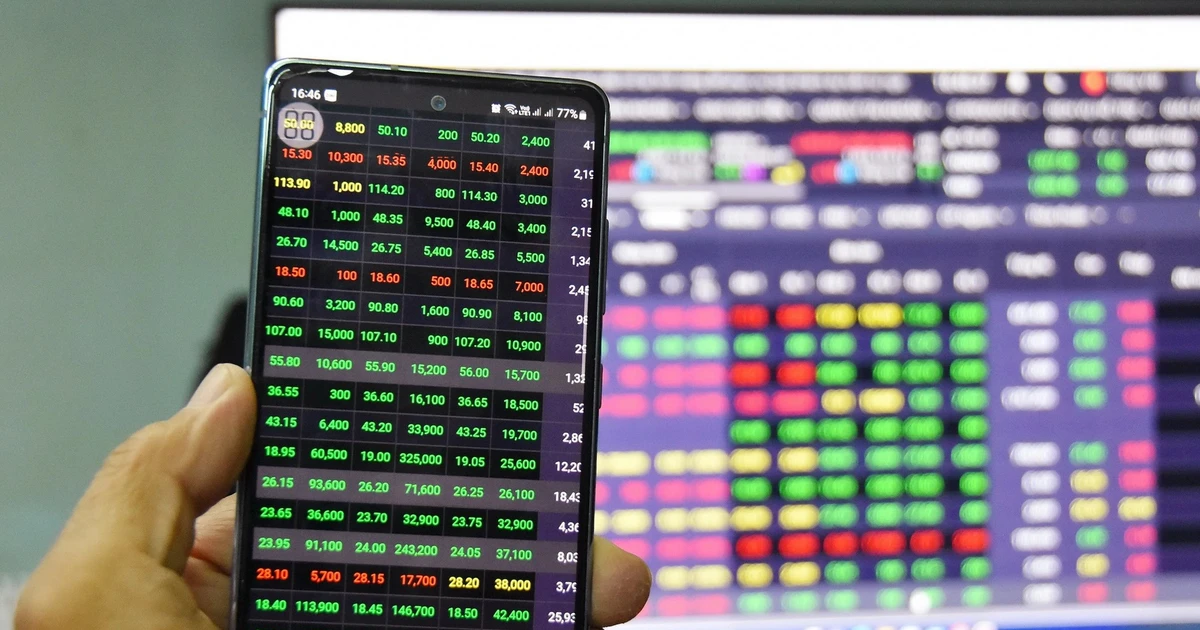

According to a survey by the Viet Nam Chamber of Commerce and Industry (VCCI), many businesses continue to report complex business registration and investment licensing procedures, as well as difficulties in accessing preferential credit due to stringent regulations, undermining business confidence.

Specifically, as many as 54% of enterprises said they struggled to access credit; 74% had to delay or cancel expansion plans due to slow access to land; and only 32% intended to expand investment over the next two years. Notably, 55.3% of businesses reported that red tape remained prevalent.

In particular, institutional frameworks and policies aimed at promoting business development remain inadequate, failing to create sufficiently favourable conditions for Vietnamese enterprises to invest and enhance their production and business capacity. The effectiveness of policies supporting business development has yet to be clearly felt.

Against this backdrop, Hoang Manh Cam, Chief of the Board Office of the Viet Nam National Textile and Garment Group (Vinatex), called on the government to continue issuing concrete green credit policies with clear targets to encourage enterprises to invest in appropriate green and circular economy pathways.

At the same time, businesses should be supported to make more effective use of the 17 new-generation free trade agreements (FTAs) that Viet Nam has signed, in order to expand markets and boost exports. He also proposed corporate income tax deductions of 10% or more to provide enterprises with resources for reinvestment and wage payments.

For the fisheries sector, Nguyen Hoai Nam, Secretary General of the Viet Nam Association of Seafood Exporters and Producers (VASEP), recommended the early development of an integrated raw material data system, linking fishing ports with central authorities, to support management and enable the government to issue appropriate directives and policy decisions.

In addition, seafood auction markets should be established to enhance transparency and improve fisheries management. Regulatory agencies should also actively support enterprises in anti-dumping and countervailing duty cases brought by the US against Vietnamese shrimp, helping them navigate new investigation phases.

At the same time, consideration should be given to increasing trade promotion funds for key export sectors, including fisheries.

Expectations for a policy lever

In 2026, Viet Nam has set a growth target of 10%, which requires the entire economy to accelerate. Accordingly, the business community and entrepreneurs are expecting administrative procedure reforms and business conditions to undergo more substantive reform, alongside continued policies to support production, business activities and exports, as well as expanded access to land and credit resources.

Nguyen Tuan Khoa, Deputy Director of Phuoc Thanh II Co., Ltd. (Tay Ninh Province), expressed his hope for continued, more practical support from agricultural credit policies that are better aligned with sector-specific characteristics, particularly medium- and long-term loan packages with reasonable interest rates for investment in raw material zones, warehousing and processing.

He also stressed the need for greater flexibility in policy management at different times, enabling enterprises to proactively organise production along value chains, improve operational efficiency and respond swiftly to market fluctuations.

According to VCCI President Ho Sy Hung, 2026 is seen as opening a new and highly anticipated phase. To create a lever that enables businesses to break through, the government, along with ministries, sectors and localities, needs to shift its mindset from administrative management to one focused on accompaniment, support and facilitation.

This includes continuing to issue supportive policies, reform economic institutions, improve the business environment and accelerate digitalisation to reduce compliance costs for enterprises.

Given that nearly 98% of Vietnamese enterprises are small and micro-sized, support policies must be designed to be flexible and easily accessible, with a focus on human resource training, technological transformation, access to credit and market expansion.

In particular, overlapping provisions within the current legal system must be identified and resolved decisively to strengthen market confidence and create momentum for business recovery and growth.

Action programmes to nurture enterprises should be maintained, providing support for business operations and laying the groundwork for realising the goal of two million operating enterprises by 2030.

While breakthrough resolutions have been adopted and institutional mechanisms have been opened up, it is clear that whether businesses can achieve strong development depends first and foremost on their own efforts to restructure, invest in technology, enhance governance capacity and effectively seize opportunities created by the state.

At the same time, a distinct long-term strategy is needed to better harness internal resources, innovate business models and take the lead in innovation, participation in new fields, digital and green transformation, and gradually master core technologies, thereby moving deeper into global value chains.