Positive growth thanks to effective anti-epidemic strategy

The Asian Development Outlook (ADO) report, released on April 28, states that the Vietnamese economy still grew in 2020 despite the COVID-19 pandemic and the ensuing downturn in global growth. Accordingly, the Government's effective anti-epidemic and socio-economic development measures managed to largely insulate the economy from the COVID-19 pandemic in 2020, GDP growing by 2.9% – one of the highest growth rates in the world.

In particular, economic bright spots worthy of mention were agriculture, growing by 2.7% in 2020 from 2.0% in 2019, the sector buoyed by proactive export promotion; structural transformation (for example, shifting from rice to high-value cash crops and livestock); and a dynamic private sector. Agriculture contributed 0.4 percentage points to GDP growth last year – a strong performance given the severe floods and drought, increased salinity intrusion, and a sharp drop in external demand, reported the ADB.

Industry and construction growth moderated to 4.0% in 2020, contributing 1.4 percentage points to overall growth, as effective COVID-19 controls helped maintain a stable supply of labour.

A slowdown in private investment was compensated by a 34.5% increase in public investment, among the highest levels of public investment support in Southeast Asia. External trade performed robustly despite headwinds from COVID-19. Net exports of goods and services contributed 0.3 points to growth, with export growth of 4.4% exceeding import growth of 3.9%.

Inflation averaged 3.2% in 2020 and was only slightly higher than 2019’s 2.8%, despite an unexpected increase in pork prices in the first quarter of 2020 and severe floods in the third quarter. Subdued domestic demand and a steep fall in global fuel prices largely tamed inflation.

Exports expanded by 7.0%, boosted by multilateral and bilateral trade agreements, the country’s diversification into global value chains, and trade diversion. Exports to the US, mainly mobile phones, spare parts, and textiles, increased by 25%. China surpassed the European Union in becoming Vietnam’s second largest export market after the US. Imports increased by 3.6%, with China remaining the largest source of imports, followed by the Republic of Korea and other economies in Southeast Asia.

Another economic bright spot is that Vietnam's stock market plunged in the first quarter of 2020, but quickly recovered as COVID-19 was brought under control and the State Bank of Vietnam implemented its rate cuts, attracting domestic investors back to the market. The VN Index hit 1,200 in the first quarter of 2021.

Processing, manufacturing and investment the main drivers of growth

ADB Country Director for Vietnam Andrew Jeffries said that stagnant domestic consumption and weak external demand caused by the COVID-19 pandemic slowed down Vietnam’s economy last year, but the growth momentum remains strong this year, made possible by Vietnam’s success in controlling the spread of the virus.

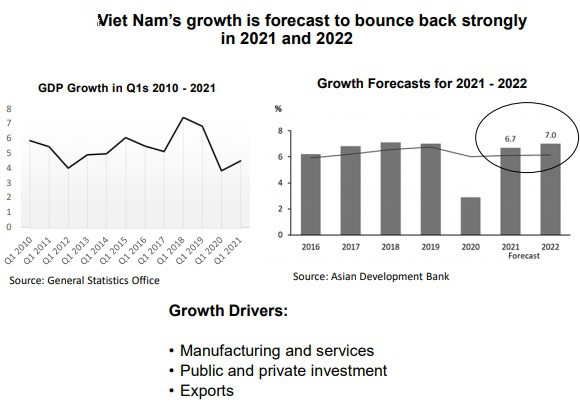

According to the ADO report, the economy is expected to grow by 6.7% in 2021 and 7.0% in 2022 – strong and steady growth made possible by Vietnam’s success in containing the COVID-19 pandemic. Vietnam’s economic growth will be boosted by export-oriented manufacturing, increased investment, and expanding trade. The growth momentum is expected to continue, thanks to ongoing reforms to improve the business environment and Vietnam’s participation in multiple free trade agreements involving almost all advanced economies.

Commenting on this growth trend, Nguyen Minh Cuong, Principal Country Economist of ADB Vietnam, said that with Vietnam's experience in the fight against the epidemic, as well as the confidence of the people and investors, as well as a new government with the determination to return the economy to its previous levels of growth, Vietnam's economic prospects in 2021 are very positive in the global context.

Nguyen Minh Cuong, Principal Economist of ADB Vietnam, said that Vietnam's economic prospects in 2021 remain positive despite COVID-19.

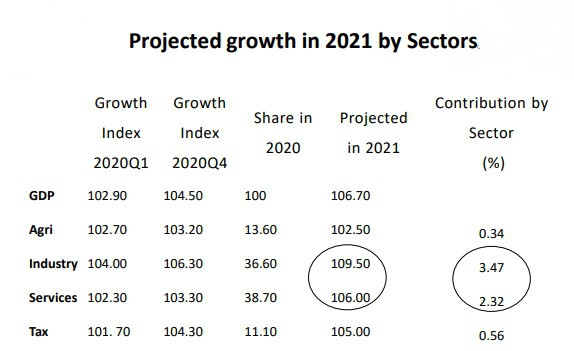

The main growth drivers for Vietnam this year will be industry, in which processing and manufacturing associated with exports will be key. Industry is forecast to expand by 9.5% in 2021, contributing 3.5 percentage points to GDP growth. The sector got off to a strong start in the first quarter of 2021, as it grew by 6.3% from the first three months of 2020.

In addition, increased investment will also be a key driver of growth this year and next, according to the ADB Vietnam's chief economist. Vietnam’s success in containing COVID-19 and the new Investment Law, passed in January 2021, reducing business regulations, are expected to attract further foreign investment. Registered foreign direct investment increased by 17.8% in the first quarter of 2021 from the same quarter last year. Overall investment growth will be further spurred by private investment, which has already risen substantially, stimulated by low interest rates and rising public spending.

The recovery of its major trading partners will also increase production demand for exports, in turn significantly expanding Vietnam’s trade and growth prospects. Trade will remain robust in 2021, supported by strong economic recoveries in China and the US, Vietnam’s two major trading partners, and the country’s participation in 15 major free trade agreements involving almost all advanced economies. Vietnam posted a US$2 billion merchandise trade surplus in the first quarter of 2021, with exports to China surging 24.3%, and by 32.8% to the US. Merchandise exports are forecast to rise by 8.0% this year and next.

Other positive prospects include the service sector, forecast to rebound by 6.0% in 2021, contributing 2.3 percentage points to GDP growth. The growth in services is coming from digital transformation, increased spending on COVID-19 vaccines, buoyant business sentiment, and low interest rates.

A stronger agriculture sector is expected this year with continued structural reforms, greater market access for agriculture exports under regional free trade agreements, and higher global food prices due to rising demand.

Construction is expected to pick up quickly as the government continues to accelerate major infrastructural projects in 2021 and low interest rates stimulate property development.

The purchasing managers’ index rose to 53.6 in March, its highest since January 2019. New foreign and local firms are expected to be established due to COVID-19 vaccines enabling greater mobility at home and, in the case of foreign investors, travel to Vietnam.

Private consumption is expected to recover in tandem with private investment and modest inflation. Retail sales rose 5.1% in first quarter of 2021, indicating a recovery in consumer confidence. Business sentiment is buoyant, as shown by a December 2020 survey in which 80% of respondents expect business conditions to either improve in 2021 or remain stable.

Credit growth should improve in 2021, aided by interest rate cuts in 2020 and revived credit demand from businesses.

Softening the negative impacts of COVID-19

However, the director of ADB Vietnam also said that significant risks remain this year and next, including the emergence of new coronavirus variants and the uneven global COVID-19 vaccine rollout, which could delay Vietnam’s return to its strong pre-pandemic growth path, given the country’s reliance on external trade.

Sharing the same point of view, Cuong said that the main risk for growth still arises from the COVID-19 epidemic. The renewed outbreaks indicate that it will still take time to stop the epidemic while vaccination plans are only at an early stage. In addition, the impacts of the pandemic on income and poverty are still significant. A prolonged pandemic may convert the short-term economic impacts into mid- to long-term systemic problems.

Against such a backdrop, the ADO report recommended Vietnam maintain inclusive growth by softening the pandemic’s impact on poverty and income. It urged the government to adopt a long-term sustainable strategy to help the poor and vulnerable diversify their livelihoods through measures such as vocational training and improved access to microfinance for new businesses.

To tackle the COVID-19 pandemic’s impacts on income and poverty, the government, on April 9 2020, passed Resolution 42, a social security programme equal to 0.2% of GDP (approximately US$0.5 billion) to provide cash transfers to individuals, households, and businesses. The resolution is expected to help reduce the 2020 poverty rate by 1.3 percentage points (to 4.9%), and particularly benefit households of ethnic minorities, typically in the poorest income quantile, and those in rural areas, as their incomes have tended to be those hardest hit by the pandemic. Although Resolution 42 could be highly effective in reducing poverty, the programme in itself may not be enough to lift the most vulnerable groups out of poverty.

ADB experts recommended the cash transfer programme needs to be strengthened to prevent further income losses among the poorest and most vulnerable groups. Because COVID-19’s impact on incomes has been highly heterogenous, support to those working in the most affected sectors should be prioritised.

In addition, building a comprehensive monitoring and evaluation system for current and potential social assistance beneficiaries that also includes those in the informal sector would be useful in terms of reaching those in need.