The committee also discussed the investment policy of the Long Thanh International Airport project and the draft revised Bankruptcy Law.

Notably, regarding the draft revised Law on Personal Income Tax, the Government proposed raising the revenue threshold exempt from tax for business households from 200 million VND (over 7,580 USD) to 500 million VND per year. The 500-million-VND level would also serve as the deductible amount before calculating tax on the revenue exceeding that threshold.

According to calculations by the tax authorities, with the application of this new threshold, about 2.3 million business households, or around 90% of the current total, will not have to pay tax. For households with annual revenue between more than 500 million VND and 3 billion VND, the draft adds a regulation applying taxation based on income with a 15% rate to ensure fairness.

The draft is scheduled to be submitted to the NA for voting on the morning of December 10.

On this matter, NA Chairman Tran Thanh Man requested clearer explanations on taxing revenue instead of income, ensuring the rationality of tax brackets and the gaps between them, and setting family circumstance deductions based on price and income fluctuations as well as the socio-economic situation.

Meanwhile, commenting on the draft amended Law on Tax Administration, the NA leader called for stronger application of technology to tax administration, ensuring adequate infrastructure, IT systems, databases, risk management tools, automated processes, and information security.

Regarding the draft law amending and supplementing several articles of the Law on Public Debt Management, the top legislator asked the Government to continue reviewing it to ensure coherence among provisions, appropriate legislative techniques, and overall persuasiveness.

On adjustments to Long Thanh’s investment policy, NA Vice Chairman Vu Hong Thanh stated that the Standing Committee agreed with the Government’s proposal to seek the NA's permission for the Government to approve the feasibility study report for Phase 2 of the project under its own authority without submitting it to the NA for approval. This aims to expedite the preparation for the phase, save time and costs, shorten implementation schedules, and enhance investment efficiency.

Regarding the draft revised Bankruptcy Law, Chairman Man confirmed that many opinions have supported renaming it the “Law on Recovery and Bankruptcy”.

He noted that the bill includes a target of prioritising business recovery, revises concepts and conditions for bankruptcy, introduces electronic procedures and simplified processes, and provides for court jurisdiction, international cooperation, and regulations on advance payments and responsibilities after bankruptcy.

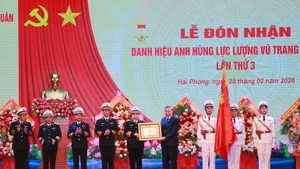

![[Photos] Party General Secretary presents title “Hero of the People’s Armed Forces” to the Navy](https://en-cdn.nhandan.vn/images/5992a12dd6e78b9bfb434962ff1830731c3ef6c1538d722fbb2593b0fa31ecfe38d01cdaaaab03a54304ad015b6d4ff5bdeadcaf72af28ae748ff126afbb566c/280226-tbt-6.jpg.webp)