The Ministry of Finance’s assessment of the implementation of the state budget-finance tasks in 2024 showed that the fiscal policy management is still proactive, reasonably expanded, effective, focused, and key; the state budget collection work is implemented drastically, evenly, and strictly managed, in parallel with saving regular state budget expenditures to concentrate resources for development investment. The financial sector has well organised and implemented tax laws and state budget collection tasks.

Accordingly, the industry strengthens management and resolutely implements the work of collecting state budget revenue from the beginning of the year; expands the tax base, reviews revenue sources to collect correctly, fully, and promptly collect arising amounts according to the provisions of law; promotes the fight against revenue loss in key areas and areas with many risks, especially land, real estate business, petroleum, gold, e-commerce, cross-border transactions, etc.; strengthens inspection, examination, and strict handling of violations and fraud in tax declaration and refund; urges the handling of tax arrears.

At the same time, it has promoted administrative procedure reform, digital transformation, modernisation, application of information technology, and implementation of electronic tax management; continue to expand the provision of electronic tax services for taxpayers, apply eTax on mobile platforms (eTax Mobile) for individuals and business households; deploy a data portal on e-commerce platforms and e-invoices with tax authority codes generated from cash registers for businesses and business households operating and providing goods and services directly to consumers; Project to build a large data center on e-invoices, applying AI technology in data analysis,... Determined to complete the highest level of the state budget collection task in 2024, striving to increase revenue in areas and fields with conditions.

|

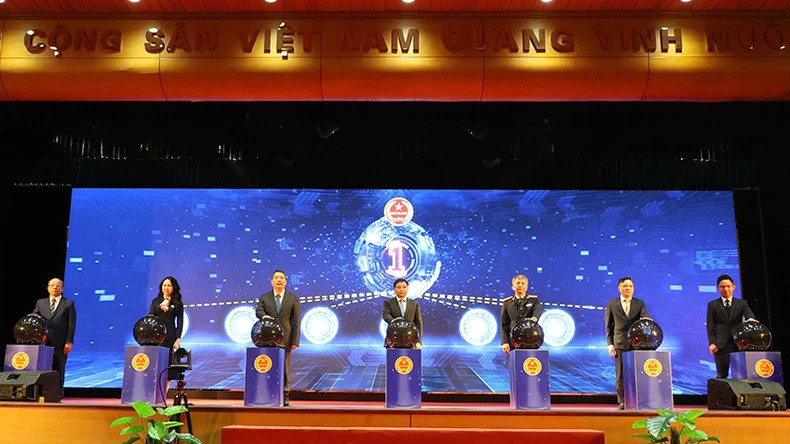

| Ceremony to officially activate the operation of the electronic information portal for households and individuals doing business to register, declare, and pay taxes from e-commerce and business on digital platforms. |

By December 27, 2024, the state budget revenue reached 1,997.3 trillion VND, equal to 117.4% (an increase of 296.3 trillion VND) compared to the estimate. Of which, domestic revenue reached 115.2% of the estimate, revenue from crude oil reached 126.2% of the estimate, and the balance revenue from import-export activities reached 134.2% of the estimate. These are the highest results ever, in the context of many fluctuations in the general domestic and international context.

The Ministry of Finance has directed the Tax and Customs agencies to focus on implementing the collection work in the last days of the year, urging the full and timely collection of arising revenues, revenues that have expired the extension period according to regulations, and receivables according to the conclusions and recommendations of the State Inspectorate and Audit agencies; strengthening the collection of tax arrears, fighting against smuggling, trade fraud, tax evasion, and budget losses.

Striving for the whole year's revenue to reach an estimated VND 2,025.4 trillion (of which, central budget revenue was estimated at 123.7% of the estimate, local budget revenue was estimated at 114.4% of the estimate), an increase of 19.1% (VND 324.4 trillion) compared to the estimate, an increase of 15.5% compared to the implementation in 2023.

The mobilisation rate into the state budget reaches 17.8% of GDP, of which taxes and fees alone reach 14.2% of GDP, contributing to having more resources to create sources for reforming salary policies, handling important, urgent and sudden issues, increasing development investment spending and ensuring social security.

Along with the effective implementation of tax laws and the task of collecting the state budget in 2024, the Ministry of Finance has proactively researched and proposed to competent authorities to continue issuing policies on exemption, reduction, and extension of taxes, fees, charges, and land rents to remove difficulties and support businesses and people, with a support scale of about 191 trillion VND (of which: the amount of tax and land rent extended is about 95 trillion VND; the amount of tax, fees, and charges reduced is about 96 trillion VND).

The value-added tax rate is reduced by about 49 trillion VND; the environmental protection tax on gasoline, oil, and grease reduces the state budget revenue in 2024 by about 42.5 trillion VND; the amount of tax with extended deadline for payment of value-added tax, corporate income tax, personal income tax, and land rent in 2024 is about 84 trillion VND; The tax amount with extended payment deadline is about 10.7 trillion VND.

In particular, the 50% reduction in registration fees will reduce about VND 2,600 billion; the reduction in collection for 36 fees and charges will be about VND 800 billion; the tax adjustment in import and export tax policies is expected to reduce revenue by about VND 588 billion/year.

The estimated implementation results by the end of December are that the total exemption, reduction, and extension of taxes, fees, charges, and land rents for businesses and people is about VND 197.3 trillion (including policies implemented from 2023, continuing to reduce state budget revenue in 2024), of which the exemption and reduction is about VND 99 trillion; the extension is about VND 98.3 trillion.

Policy solutions to exempt, reduce, and extend taxes, fees, charges, and land rents have been issued and implemented in 2024 and 2025, with large scale and wide scope of support, have brought about positive effects, timely supported production and business activities; created more jobs for workers, contributed to controlling inflation, stabilising the macro economy, and ensuring social security.