Between 2016 and 2023, the private sector recorded an impressive growth rate of 6-8% per year, outperforming the national average, especially in comparison to the state and FDI sectors. Reflecting on the past 40 years of development, Dr Le Duy Binh, Managing Director of Economica Viet Nam, said the private sector in Viet Nam has made great strides, transforming from a fragmented, small-scale sector into a vital pillar of the economy. It now contributes about 60% of GDP, 98% of total export turnover, and provides employment for approximately 85% of the national workforce.

The need for major economic corporations

Viet Nam already has a strong contingent of private enterprises with significant capital, technological capability, and management capacity. Prominent names such as Vingroup, Thaco, and Hoa Phat not only master technology, lead in innovation, and build sustainable development ecosystems, but also address major national challenges, contributing to an independent and self-sufficient economy. The growth of these businesses has substantially bolstered the economy while easing pressure on the state budget and promoting the restructuring of the economy aligned with renewing the growth model.

In the Republic of Korea, chaebols like Samsung and Hyundai played a key role in shifting the economy from agriculture to industry within just a few decades. Despite difficulties, in 2024, the country’s per capita income surpassed 36,000 USD for the first time. Clearly, nations aspiring to global standing need robust corporations capable of competing internationally. Only large-scale, capable corporations can afford to invest in technology, research and development (R&D), and improve product and service quality.

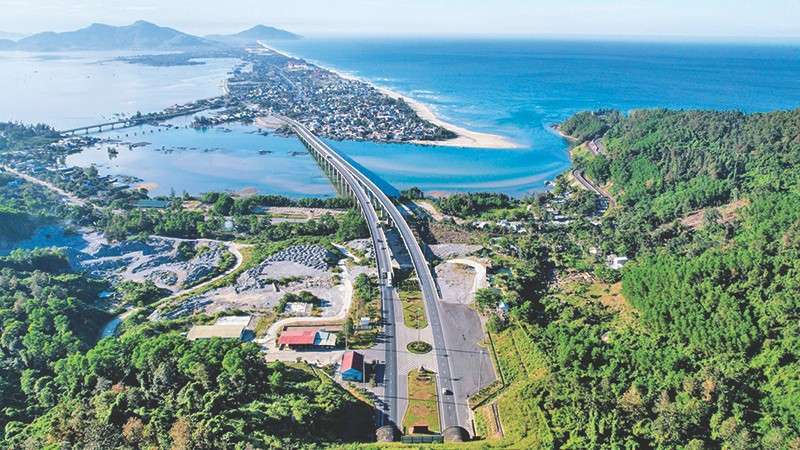

Ho Minh Hoang, Chairman of Deo Ca Group, stated that the group is ready to take on major upcoming national projects. Over the years, Deo Ca has paid special attention to human resource development, proactively training across multiple levels and sectors throughout the company, investing in next-generation talent, and closely collaborating with both domestic and international training institutions.

However, the Vietnamese business community still faces many difficulties and challenges and has yet to fully assume the pioneering role expected of it. Linkages between large and small enterprises remain limited. The rate of small and medium-sized enterprises (SMEs) participating in supply chains of large domestic firms is still low.

In terms of scale, financial strength, and global reach, Vietnamese corporations remain relatively underpowered compared to regional competitors. A quick glance at Thailand reveals a significant gap. Thanks to effective global strategies, robust infrastructure, and strong capital mobilisation, Thai private corporations have established a solid international presence.

According to the World Economic Forum’s 2023 Global Competitiveness Index (GCI), Viet Nam ranked 77th out of 140 economies, dropping three places from the previous year. Thailand, meanwhile, ranked 30th. A contributing factor is that Thailand has many corporations strong enough to compete globally, whereas Viet Nam still relies heavily on foreign direct investment.

Domestically, corporations like Vingroup, Hoa Phat, and Masan play a dominant role in the private sector. Viet Nam has set the goal of making the private sector a key driver, leading in technology application and innovation, and contributing about 70% of GDP by 2030. This target will be difficult to achieve without significant breakthroughs from leading corporations.

Thai conglomerates such as CP Group and PTT operate not only across Southeast Asia but globally, mastering technology and dominating key sectors—from agriculture to telecommunications and energy—with annual revenues in the tens of billions of USD. In fact, many Thai giants already own leading businesses in Viet Nam. They are active across diverse industries and hold a particular advantage in manufacturing, which constitutes the majority of Thailand’s FDI in Viet Nam.

Clearly, a strong economic group does not merely dominate domestically. Their investment capacity and reach must extend to other countries. While some Vietnamese corporations have attempted to expand abroad, many of their projects have failed to impress or yield the expected returns. For now, it seems Viet Nam’s large corporations are more observers than key players in the global game.

Paving the way for breakthroughs

The Politburo’s Resolution 68 on developing the private sector calls for the rapid formation and development of large and medium-sized enterprises and private economic groups with regional and global reach.

In practice, this means scaling up and enhancing the competitiveness of enterprises, supporting innovation, digital transformation, access to credit, market expansion, and increasing private sector participation in key national projects. It also requires diversifying and improving the efficiency of cooperation between the State and the private sector.

At a recent seminar, Dr Nguyen Dinh Cung, former Director of the Central Institute for Economic Management (CIEM), shared that Viet Nam should prioritise the development of 3-5 multi-sectoral corporations with a scale of over 20 billion USD within the next 10 years. To achieve this, the economy must be built on a solid foundation of SMEs. Each tier of business, from startups to small, medium, and large enterprises, will grow naturally, eventually giving rise to major corporations.

Meanwhile, Dr Le Dang Doanh emphasised the need for a shift in investment thinking, noting that Vietnamese enterprises currently invest far too little in R&D—less than 1% of revenue—whereas large Thai corporations such as SCG spend 3–5%. In agreement, Professor Nguyen Dinh Duc from the University of Engineering and Technology, Viet Nam National University, Ha Noi, noted that in the 1960s, the Republic of Korea and Viet Nam had nearly equal per capita incomes. However, Korea prioritised technology as the core of its development strategy.

The business environment is considered one of the most crucial factors in fostering private sector development. Therefore, simplifying administrative procedures is necessary, but more importantly, transparency and openness must be ensured in policy implementation. Enterprises need clear, understandable guidance on relevant processes and procedures. Additionally, the State must build fair and transparent mechanisms for resolving disputes to build trust among businesses participating in the market. Reducing transaction costs in business is more important than cutting compliance costs, as it allows businesses to focus more on production, operations, and market expansion.

Nguyen Thi Nga, Chairwoman of BRG Group, shared: “I propose the introduction of financial support policies for construction and carbon-neutral projects, including tax incentives and administrative procedures. We also need innovation research and application centres to strongly encourage businesses to adopt clean technology and renewable energy. This will make a vital contribution to the Prime Minister’s international commitment to greenhouse gas emission reductions, with the goal of achieving net zero by 2050.”

In certain cases, bold policies are required to pave the way for enterprise to make breakthroughs. The State should not replace businesses, but instead create favourable conditions for their development, fair competition, and successful integration.