At the end of September 2024, Prime Minister Pham Minh Chinh signed Decision 1018/QD-TTg to issue the Strategy for the Semiconductor Industry Development Strategy by 2030, with a vision toward 2050. This marks a significant step in positioning Vietnam as one of the leading global centers in the semiconductor field, an industry that is becoming a pillar of the global economy.

The Prime Minister set a target for the development of Vietnam’s semiconductor industry in three phases. In Phase 1 (2024 - 2030), the focus will be on attracting selective foreign direct investment (FDI), establishing at least 100 design companies, one small-scale semiconductor chip manufacturing plant, and 10 semiconductor packaging and testing factories. Additionally, the development of several specialised semiconductor products for various industries and fields will be prioritised.

It is time to choose FDI

According to a report from the Ministry of Planning and Investment (MoPI), by the end of October, Vietnam had attracted over 27 billion USD in FDI, with adjusted registered capital increasing by nearly 42%. It is expected that Vietnam could attract around 39-40 billion USD in FDI for the entire year of 2024.

With these results, representatives of the Vietnam Association of Foreign-invested Enterprises (VAFIE) believe that 2024 could be a successful year for FDI attraction to Vietnam, and the country is also facing a once-in-a-lifetime opportunity in the semiconductor “race.”

Many large global semiconductor companies have already made significant investments in Vietnam. Among these are projects worth hundreds of millions of USD, even billions of USD, such as those from Intel, Amkor, and Hana Micron. In addition, several domestic companies, including Viettel, FPT, and VNChip, have actively entered the semiconductor industry market. It is forecasted that by 2024, Vietnam’s semiconductor industry will be valued at around 6.2 billion USD.

In terms of the overall context of FDI attraction, representatives from the VAFIE expressed their believes that Vietnam is considered a successful model in attracting FDI, thanks to an increasingly refined investment framework, political stability, and a high economic growth potential.

However, the FDI sector has revealed certain shortcomings, particularly the negative aspects and the "unintended consequences" of FDI attraction. When considering the benefits—an important criterion in FDI activities—Vietnam still faces a disadvantage as foreign investors transfer "huge profits" back to their home countries.

Regarding technology and management, Vietnam has not yet gained significant management skills and has almost not received technology transfer impacts from FDI projects. Some FDI companies invest in Vietnam merely to take advantage of cheap labour and investment incentive policies. Currently, around 68.5% of FDI businesses evaluate Vietnam as having more favorable investment conditions compared to other countries they consider for investment, such as lower costs, better labor quality, tax incentives, and a more responsive government in dealing with emergencies than other nations.

Therefore, in order to successfully implement the Semiconductor Industry Development Strategy, according to experts, it is time for Vietnam to have the right to choose, to say 'no' to FDI projects that do not meet the requirements or align with the country's economic and social development directions. This is also a way to create space for domestic businesses to grow. When they no longer have to compete with foreign "giants" who enjoy numerous incentives, Vietnamese enterprises will have the opportunity to develop, enhance their competitiveness, and contribute more to the economy.

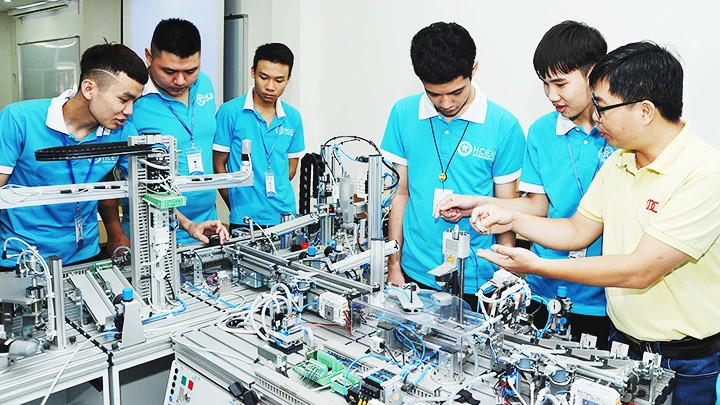

| Manufacturing electronic components at Channel Well Technology Vietnam Co., Ltd., Quang Minh Industrial Park (Me Linh District, Hanoi). (Photo: PHAM HUNG) |

Vietnam is ready

Minister of Planning and Investment Nguyen Chi Dung affirmed that Vietnam has gathered all the conditions to be ready to welcome and cooperate with businesses and investors from around the world in the semiconductor industry.

Vietnam boasts a stable political environment and strong determination from the Party and State leadership to promote innovation and the development of advanced technology sectors. The Party and Government are fully aware that Vietnam is at a crucial point in the transition toward a digital economy, green economy, and circular economy.

Moreover, with a population of over 100 million, Vietnam is currently in its "golden population" phase, with a young and enthusiastic workforce, full of energy and a desire to contribute. This workforce has quick access to science, technology, and STEM fields, making it a valuable resource and market for high-tech industries. The Vietnamese government is also setting high demands for comprehensive digital transformation in all sectors. As a result, Vietnam is becoming a major "customer and partner" for global technology corporations like Google, Meta, and Amazon, with an ever-expanding market share.

Moreover, Vietnam has established a semiconductor industry ecosystem with the participation of many high-tech partners and businesses. By expanding relations with reputable semiconductor partners worldwide, we have been implementing the motto that "If you want to go fast, go alone; if you want to go far, go together”; as well as always accompanying partners and businesses to gradually assert our position on the global semiconductor map.

Notably, Vietnam has built an attractive business environment with many incentives for high-tech companies. It is expected that in 2024, the Government will issue a decree on the establishment, management, and use of an investment support fund to directly assist companies in this field with training, human resource development, investment in fixed assets, production of high-tech products, etc., contributing to enhancing Vietnam's position on the global semiconductor industry map.

Dung also stated that Vietnam's goal is not only to participate in the global value chain but also to build an advanced and attractive semiconductor industry ecosystem in the region and the world, helping Vietnam achieve self-reliance and sustainable development in this field.

"The Vietnamese Government has identified leveraging Vietnam's cultural and human strengths to become a strategic breakthrough in the development of the country's socio-economic growth in the new era. This includes focusing on investment in the development of high-quality human resources for the semiconductor industry to meet domestic and international demand. The MoPI has submitted to the Prime Minister for the approval of the Vietnam Semiconductor Human Resource Development Programme, aiming to train at least 50,000 university-level workers by 2030, with 1,300 lecturers specialised in semiconductors, and to build national and local laboratories for human resource training serving the semiconductor industry ", Dung said. He also added that the National Innovation Centre has also closely cooperated and garnered the participation and support of major semiconductor companies like Cadence, Synopsys, Qorvo, Siemens, Marvell, ARM, and Samsung.

Currently, there are over 50 semiconductor industry companies operating in Vietnam. Among them are many major names in the global semiconductor industry that have decided to invest in Vietnam, such as Intel, Amkor, Ampere, Marvell, Cadence, Renesas, Synopsys, Qorvo, and others.