According to the Institute of Strategy, Policies on Agriculture and Environment (under the Ministry of Agriculture and Environment), green investment refers to the allocation of capital to projects, assets, or activities that generate measurable positive environmental and social impacts.

The aim of green investment is to reduce carbon emissions, optimise resource use, and protect ecosystems, while serving as a financial lever for achieving the United Nations’ Sustainable Development Goals (SDGs). Green investment activities focus on sectors such as renewable energy, green infrastructure, clean transportation, smart agriculture, waste management, and clean water.

In addition to reducing emissions and protecting the environment, green investment must also ensure sustainability, stability, and risk reduction for investors.

The Government has issued multiple important strategies and national proposals to facilitate green investment. Notable among them are: the Green Growth Strategy 2021–2030, with a vision to 2050 (Decision 1658/QD-TTg), which orients economic growth toward low emissions and increased resilience; the National Climate Change Strategy (Decision 896/QD-TTg, 2022), outlining comprehensive solutions for mitigation and adaptation; the Carbon Market Development Scheme (Decision 232/QD-TTg, 2025), establishing a domestic carbon credit trading mechanism; and the Pilot Scheme and National Action Plan on Circular Economy (Decision 687/QD-TTg, 2022), promoting efficient resource use and waste reduction.

Importantly, the Green Taxonomy (Decision 21/2025/QD-TTg, issued July 4, 2025) provides clear classifications for green projects and is considered the most critical legal instrument guiding capital flows into green investment in Viet Nam.

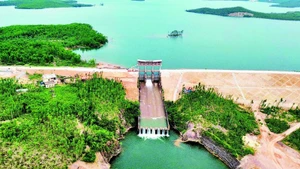

Decision No. 21/2025/QD-TTg lists and categorises green projects as follows: 10 energy projects; three transport projects; two construction projects; three water resource projects; 12 agriculture, forestry, fisheries, and biodiversity conservation projects; six processing and manufacturing projects; and nine environmental services projects.

However, given the current availability of capital, urgency, and implementation capacity, priority sectors include energy, transport, and agriculture.

The World Bank estimates that Viet Nam will need around 368 billion USD between now and 2040 to fully implement the measures required to reach Net Zero by 2050.

A report by McKinsey — one of the world’s leading strategic consulting firms — titled “A Roadmap for Viet Nam to Achieve Net Zero” warns of two major risks: impacts from global climate change and the high GDP share of carbon-intensive industries. Despite having clear priorities and targets, the enormous investment demand and potential risks remain significant challenges for Viet Nam’s economy.

Global experience shows that the circular economy is the central pillar in transitioning to a new growth model.

On January 23, 2025, the Prime Minister issued Decision 222/QD-TTg approving the National Action Plan on Circular Economy through 2035. Under this plan, green or transitioning sectors will move toward circular production cycles, maximising product value recovery and reducing emissions.

To achieve this, sectors must form linkages based on real demand, creating closed-loop cycles that evolve into clusters, zones, and inter-regional systems involving multiple enterprises in the same production chain.

This model has been adopted in countries such as the US, China, Japan, India, the European Union, Canada, and others — many of which aim to achieve Net Zero earlier than Viet Nam.

Strengthening policies for green investment will unlock major opportunities for Vietnam, including: attracting concessional finance from global climate funds and ESG investors; modernising technology, particularly in renewable energy and clean production; and creating more green and sustainable jobs.

However, to attract sustainable and effective capital flows, Viet Nam must develop a robust legal framework to monitor green project implementation and improve incentive mechanisms for investors. It is also essential to ensure a transparent, stable, and consistent investment environment, while eliminating administrative and legal barriers.