After hardship due to a decline in orders, from the end of 2023, Khai Hoan Export Wood Processing Joint Stock Company has continuously received new orders to be fulfilled until the end of 2025.

In 2023 alone, the company produced and exported more than 1,000 containers of wooden furniture to the US and Canadian markets. The positive situation at the end of the year helped the company achieve higher revenue in 2023 compared to 2022.

According to wooden furniture businesses, promoting deep processing is an important solution for businesses to receive orders when market demand increases again.

The positive signal of Khai Hoan Company is also the general picture of wood enterprises in the first months of this year.

Data from the Ministry of Industry and Trade showed that the export turnover of wood and wood products reached 1.3 billion USD in April 2024, an increase of 0.2% compared to March 2024, and an increase of 19.4% compared to April 2023. The accumulated export revenue of wood and wood products was estimated to reach 4.84 billion USD in the first four months of this year, up 23.7% over the same period in 2023. Of which, the export turnover of wood products was reported at 3.3 billion USD, up 25.8% over the same period in 2023.

Ngo Sy Hoai, Vice President and General Secretary of the Vietnam Timber and Forest Products Association, said that Vietnam’s wood processing and export industry has many advantages, thanks to the highly skilled labour force, abundant wood raw materials, legally imported wood, and its capability of producing traceable products.

On the other hand, designs of Vietnamese wood products are also increasingly diverse, meeting the needs of the world market.

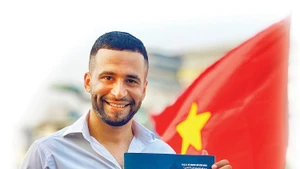

Giafar Safaverdi, Managing Director of IKEA Purchasing & Logistics Area South East Asia under IKEA Group (one of the world’s largest furniture exporting corporations) said that Vietnam was considered an important wood supply market for IKEA’s suppliers. The country supplies a large amount of Acacia wood, a type of dark wood certified by the Forest Stewardship Council (FSC), suitable for IKEA’s outdoor furniture products.

According to experts, businesses in the wood and handicraft industry are facing a breakthrough opportunity in 2024, as inflation in the US, Vietnam’s largest wood import market, has become less severe. In addition, inventories in the US market have dropped to low levels and importers will return to placing orders in 2024.

In 2024, the market shows signs of a slight recovery, with more demand for imported raw materials. Domestically, lending interest rates are stable, while businesses already have a year of experience in managing cash flows, so difficulties have eased.

Proactively seizing opportunities

Despite opportunities, difficulties for wooden furniture exporters have not yet ended. Dr Le Quoc Phuong, former deputy director of the Industry and Trade Information Centre, analysed that Vietnamese furniture businesses are mostly small and medium-sized enterprises, with low technology levels and limited financial resources, which are not sufficient to invest in technology to improve product quality and competitiveness.

In addition, Vietnam’s wood industry mainly produces and exports low-value products such as woodchip, which currently ranks first globally. The items with higher export value, such as wooden planks, and interior and exterior furniture have low proportions and low wood use efficiency.

Moreover, external challenges remain, such as complicated geopolitical conflicts, increasing logistics costs, Europe’s application of regulations on preventing forest degradation from late 2024, carbon taxes, the US imposition of anti-dumping regulations and the investigation of kitchen cabinets.

In that context, Dr Le Quoc Phuong said that wood exporters need to diversify markets by focusing on trade promotion in potential markets which have not been exploited much, such as the Middle East, Africa, Eastern Europe, and Northern Europe.

Furthermore, large exhibition centres for wooden furniture should be formed to advertise the brand of Vietnam's wood industry.

Giafar Safaverdi added that trade integration frameworks provide advantages for Vietnamese businesses to export wood with low taxes. Therefore, manufacturers need to concentrate on complying with international standards, improving product quality researching trade support policies, as well as updating global consumer trends and preferences.

Additionally, building a strong distribution network and focusing on developing sustainable business activities will help businesses utilise the full potential of FTAs.

Many new markets, exploited by Vietnamese wood enterprises are seeing quite good growth, such as China, India, Malaysia, Cambodia, Singapore, Laos, Indonesia, and the Philippines.

According to Ngo Sy Hoai, both Vietnamese and FDI businesses should have closer connections and more interaction to have enough capacity to fulfil large orders. The Vietnam Timber and Forest Products Association also recommends that businesses need to have more connections to better reorganise the supply chain, reduce selling prices and improve the competitiveness of Vietnamese wooden products.